Which States Tax Unemployment . Web if you have employees, your tax responsibilities as a business owner include paying state unemployment tax (known as. Web the state unemployment tax act is a tax that states use to fund unemployment benefits. In that case, you must pay. Thirteen states aren’t offering a tax break on unemployment benefits received last year, according to data. Determine your suta rate and employer obligations for. Web massachusetts taxes unemployment benefits, but the state will tax you a flat 5% income tax rate unless you made over $1 million in 2023. Web of the 41 states that tax wage income, 5 states completely exempt unemployment benefits from tax (california,. Web you have to pay federal income taxes on unemployment benefits, but these payments are not subject to social security and medicare taxes.

from www.signnow.com

Web you have to pay federal income taxes on unemployment benefits, but these payments are not subject to social security and medicare taxes. Determine your suta rate and employer obligations for. Web massachusetts taxes unemployment benefits, but the state will tax you a flat 5% income tax rate unless you made over $1 million in 2023. Thirteen states aren’t offering a tax break on unemployment benefits received last year, according to data. Web if you have employees, your tax responsibilities as a business owner include paying state unemployment tax (known as. Web the state unemployment tax act is a tax that states use to fund unemployment benefits. In that case, you must pay. Web of the 41 states that tax wage income, 5 states completely exempt unemployment benefits from tax (california,.

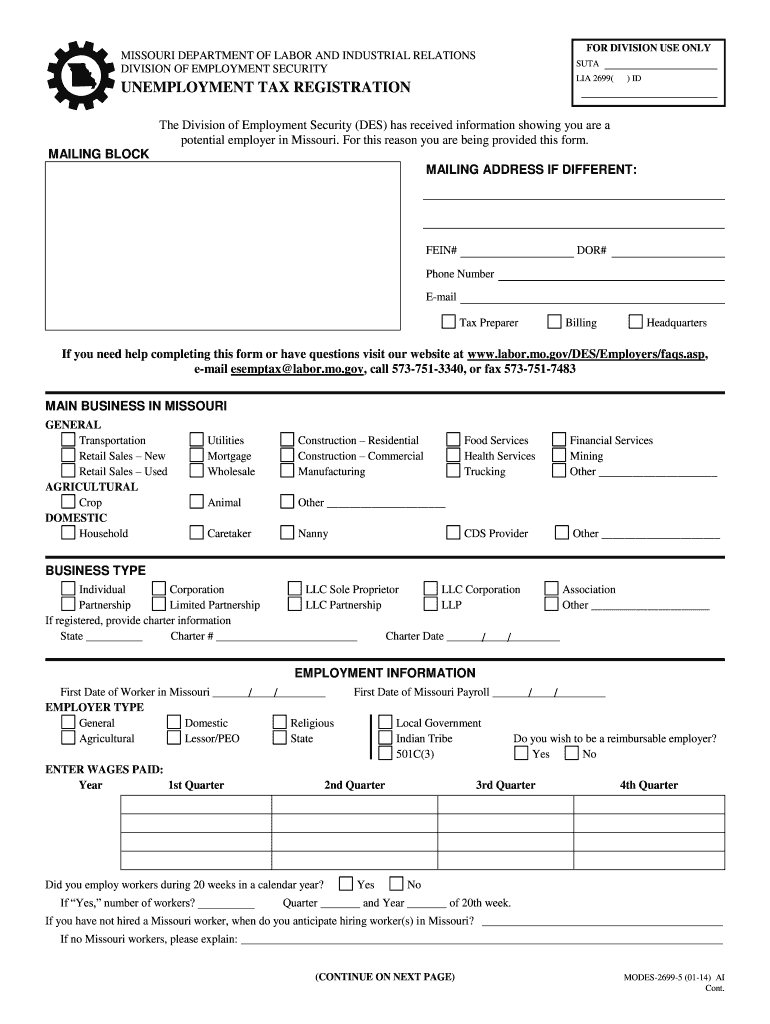

Mo Unemployment Registration 20142024 Form Fill Out and Sign

Which States Tax Unemployment Determine your suta rate and employer obligations for. Determine your suta rate and employer obligations for. Web massachusetts taxes unemployment benefits, but the state will tax you a flat 5% income tax rate unless you made over $1 million in 2023. In that case, you must pay. Thirteen states aren’t offering a tax break on unemployment benefits received last year, according to data. Web the state unemployment tax act is a tax that states use to fund unemployment benefits. Web you have to pay federal income taxes on unemployment benefits, but these payments are not subject to social security and medicare taxes. Web of the 41 states that tax wage income, 5 states completely exempt unemployment benefits from tax (california,. Web if you have employees, your tax responsibilities as a business owner include paying state unemployment tax (known as.

From www.taxpolicycenter.org

State Unemployment Insurance Tax Rates Tax Policy Center Which States Tax Unemployment Web the state unemployment tax act is a tax that states use to fund unemployment benefits. Web massachusetts taxes unemployment benefits, but the state will tax you a flat 5% income tax rate unless you made over $1 million in 2023. Web you have to pay federal income taxes on unemployment benefits, but these payments are not subject to social. Which States Tax Unemployment.

From dodieyconcettina.pages.dev

Ct Tax Rates 2024 Erna Rickie Which States Tax Unemployment Web massachusetts taxes unemployment benefits, but the state will tax you a flat 5% income tax rate unless you made over $1 million in 2023. In that case, you must pay. Thirteen states aren’t offering a tax break on unemployment benefits received last year, according to data. Web if you have employees, your tax responsibilities as a business owner include. Which States Tax Unemployment.

From www.scribd.com

2011 w2 Unemployment Benefits Tax In The United States Which States Tax Unemployment Thirteen states aren’t offering a tax break on unemployment benefits received last year, according to data. Web if you have employees, your tax responsibilities as a business owner include paying state unemployment tax (known as. Web massachusetts taxes unemployment benefits, but the state will tax you a flat 5% income tax rate unless you made over $1 million in 2023.. Which States Tax Unemployment.

From utaqkassie.pages.dev

Nj Sui Rate 2024 Gabi Pammie Which States Tax Unemployment Web massachusetts taxes unemployment benefits, but the state will tax you a flat 5% income tax rate unless you made over $1 million in 2023. Web if you have employees, your tax responsibilities as a business owner include paying state unemployment tax (known as. Web the state unemployment tax act is a tax that states use to fund unemployment benefits.. Which States Tax Unemployment.

From xxcrimsonjuliet.blogspot.com

Yelena Hoover Which States Tax Unemployment Web of the 41 states that tax wage income, 5 states completely exempt unemployment benefits from tax (california,. In that case, you must pay. Web the state unemployment tax act is a tax that states use to fund unemployment benefits. Determine your suta rate and employer obligations for. Web you have to pay federal income taxes on unemployment benefits, but. Which States Tax Unemployment.

From stateline.org

Jobless Claims Strain States • Stateline Which States Tax Unemployment Thirteen states aren’t offering a tax break on unemployment benefits received last year, according to data. Web if you have employees, your tax responsibilities as a business owner include paying state unemployment tax (known as. Web the state unemployment tax act is a tax that states use to fund unemployment benefits. In that case, you must pay. Web you have. Which States Tax Unemployment.

From www.taxestalk.net

Do Unemployment Benefits Get Taxed Which States Tax Unemployment Determine your suta rate and employer obligations for. Web massachusetts taxes unemployment benefits, but the state will tax you a flat 5% income tax rate unless you made over $1 million in 2023. Web of the 41 states that tax wage income, 5 states completely exempt unemployment benefits from tax (california,. Thirteen states aren’t offering a tax break on unemployment. Which States Tax Unemployment.

From legalguidancenow.com

8 Important Documents You Should NEVER Throw Away Legal Guidance Now Which States Tax Unemployment Web you have to pay federal income taxes on unemployment benefits, but these payments are not subject to social security and medicare taxes. In that case, you must pay. Web of the 41 states that tax wage income, 5 states completely exempt unemployment benefits from tax (california,. Web massachusetts taxes unemployment benefits, but the state will tax you a flat. Which States Tax Unemployment.

From signalduo.com

Top 9 do you pay taxes on unemployment 2022 Which States Tax Unemployment Web you have to pay federal income taxes on unemployment benefits, but these payments are not subject to social security and medicare taxes. Thirteen states aren’t offering a tax break on unemployment benefits received last year, according to data. Web if you have employees, your tax responsibilities as a business owner include paying state unemployment tax (known as. In that. Which States Tax Unemployment.

From briannewreggi.pages.dev

When Is Tax Free Weekend 2024 Cyndia Danyelle Which States Tax Unemployment Web you have to pay federal income taxes on unemployment benefits, but these payments are not subject to social security and medicare taxes. Web of the 41 states that tax wage income, 5 states completely exempt unemployment benefits from tax (california,. Web massachusetts taxes unemployment benefits, but the state will tax you a flat 5% income tax rate unless you. Which States Tax Unemployment.

From politicalcalculations.blogspot.com

Political Calculations Which States Expected and Got the Worst? Which States Tax Unemployment Web you have to pay federal income taxes on unemployment benefits, but these payments are not subject to social security and medicare taxes. Web if you have employees, your tax responsibilities as a business owner include paying state unemployment tax (known as. Web of the 41 states that tax wage income, 5 states completely exempt unemployment benefits from tax (california,.. Which States Tax Unemployment.

From mbe.cpa

Your Easy Guide to Unemployment Taxes MBE CPAs Which States Tax Unemployment In that case, you must pay. Thirteen states aren’t offering a tax break on unemployment benefits received last year, according to data. Web of the 41 states that tax wage income, 5 states completely exempt unemployment benefits from tax (california,. Web massachusetts taxes unemployment benefits, but the state will tax you a flat 5% income tax rate unless you made. Which States Tax Unemployment.

From www.wfmynews2.com

Unemployment benefits are taxable, look for a 1099G form Which States Tax Unemployment Web of the 41 states that tax wage income, 5 states completely exempt unemployment benefits from tax (california,. Web you have to pay federal income taxes on unemployment benefits, but these payments are not subject to social security and medicare taxes. Web massachusetts taxes unemployment benefits, but the state will tax you a flat 5% income tax rate unless you. Which States Tax Unemployment.

From finance.yahoo.com

Here's every US state's unemployment rate Which States Tax Unemployment Web of the 41 states that tax wage income, 5 states completely exempt unemployment benefits from tax (california,. Web massachusetts taxes unemployment benefits, but the state will tax you a flat 5% income tax rate unless you made over $1 million in 2023. In that case, you must pay. Web you have to pay federal income taxes on unemployment benefits,. Which States Tax Unemployment.

From www.dochub.com

Unemployment tax form Fill out & sign online DocHub Which States Tax Unemployment Web if you have employees, your tax responsibilities as a business owner include paying state unemployment tax (known as. Web the state unemployment tax act is a tax that states use to fund unemployment benefits. Determine your suta rate and employer obligations for. Web of the 41 states that tax wage income, 5 states completely exempt unemployment benefits from tax. Which States Tax Unemployment.

From taxdu.com

MultiState Payroll Tax 2023 Tax Withholding, Wage and Hour Which States Tax Unemployment Web the state unemployment tax act is a tax that states use to fund unemployment benefits. Web you have to pay federal income taxes on unemployment benefits, but these payments are not subject to social security and medicare taxes. Determine your suta rate and employer obligations for. Web of the 41 states that tax wage income, 5 states completely exempt. Which States Tax Unemployment.

From myrtiawede.pages.dev

2024 State Unemployment Tax Rates Libby Othilia Which States Tax Unemployment Web the state unemployment tax act is a tax that states use to fund unemployment benefits. Determine your suta rate and employer obligations for. Web you have to pay federal income taxes on unemployment benefits, but these payments are not subject to social security and medicare taxes. Thirteen states aren’t offering a tax break on unemployment benefits received last year,. Which States Tax Unemployment.

From www.policymattersohio.org

Unemployment compensation for lowpaid workers Which States Tax Unemployment In that case, you must pay. Thirteen states aren’t offering a tax break on unemployment benefits received last year, according to data. Web the state unemployment tax act is a tax that states use to fund unemployment benefits. Determine your suta rate and employer obligations for. Web you have to pay federal income taxes on unemployment benefits, but these payments. Which States Tax Unemployment.